AM Best released its annual “Asbestos & Environmental Reserves Market Segment Report” last December. The report analyzed the asbestos and environmental (A&E) disclosures to insurance companies’ year-end 2022 statutory financial statements and details the significant, ongoing impact of such claims on the insurance industry. It also highlights the extreme consolidation of such liabilities among a small group of insurers.

The report is rather technical and requires an understanding of a few key terms to interpret:

AM Best’s report considers its estimate of the ultimate level of necessary net losses needed to satisfy all insurers liabilities for asbestos and environmental claims, how much has already been paid out over the years, and how much remains reserved on insurers’ books relative to its estimate of the ultimate losses.

Ultimate Loss Estimates

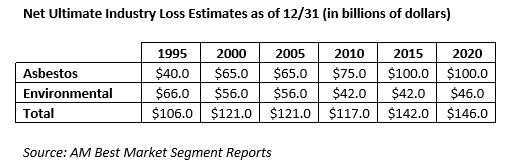

AM Best left its net ultimate A&E losses estimate of $146 billion ($100 billion for asbestos losses and $46 billion for environmental losses) unchanged and estimates that the industry has funded 95% of these losses, either by payment or through reserving. This figure is encouraging, especially when compared to 33% industry funding in 1994. Given the size of the losses, however, 95% funding still leaves approximately $6 billion asbestos and $2 billion environmental losses unfunded.

AM Best’s net A&E losses estimates have grown over time:

Notably, asbestos loss estimates have more than doubled while environmental loss estimates have declined. These estimates include only the amounts payable by the insurance industry; uninsured A&E liabilities are not included.

Reserves and Payments

Current net A&E reserves of $19.94 billion are highly concentrated among a small number of insurer groups; just ten groups account for 67% of net reserves, and the top five (Berkshire Hathaway, Hartford, Travelers, AIG, and Swiss Re, in that order) account for 44%. Berkshire Hathaway’s $2.49 billion net reserves (a 12.5% share of industry net reserves) are deceptive because it does not, for arcane accounting reasons, consider retroactive reinsurance deals Berkshire, through its subsidiary NICO, has completed with other large insurers.

Net A&E reserves have declined over the past decade as loss payments have exceeded reserve increases. As we get further and further away from the years of peak asbestos use, one would expect asbestos payments and reserves to decline. Nevertheless, the insurance industry still paid the hefty sums of $1.8 billion in asbestos and $0.7 billion in environmental losses in 2022. AM Best estimates that current A&E reserves will last approximately eight years, assuming no additional increases. It is hard to imagine that legacy asbestos and environmental liabilities will come to an end anytime soon, so I think it is safe to expect continued reserve increases.

Gazing into the Crystal Ball

AM Best’s annual report is a valuable signpost for those seeking to understand the impact of A&E losses on the insurance industry. It tells the story of an industry that has mostly come to grips with these massive liabilities, but there are reasons to believe that AM Best may have to increase its total loss estimates soon. Asbestos litigation appears to be on a long, slow decline, but asbestos talc claims, litigation funding, and other factors may disrupt this trend. Meanwhile, PFAS, coal ash, ETO, and other emerging torts are putting upward pressure on the environmental loss estimate.

Nor does the report eliminate the need for policyholders to examine the unique credit risks of their key A&E insurers. While the industry itself may be on solid footing, one need only to recall the recent Bedivere Insurance Company and Arrowood Indemnity Company insolvencies to understand that some insurers are faring much better than others.

Never miss a post. Get Risky Business tips and insights delivered right to your inbox.

Nick Sochurek has extensive experience in leading complex insurance policy reviews and analysis for a variety of corporate policyholders using relational database technology.

Learn More About Nicholas