KCIC President Jonathan Terrell has written several times in the past about the precarious financial ground on which Arrowood Indemnity Company is currently standing. See "Here We Go Again. Is Arrowood on the Path to Insolvency?", "Arrowood: Updated Analysis and Opinion" and "Arrowood: The Inexorable Decline Continues" for his past analysis.

As Arrowood’s third quarter statutory financial statements were released over the weekend, we thought another update was in order. Sadly, we have only further bad news to report.

Statutory Surplus

First, our team looked at statutory surplus, which has declined by another roughly $3 million, down to $37.8 million as of September 30, 2022. This is a $12.5 million decline from the $50.3 million in surplus as of December 31, 2021, a nearly 25% decrease in surplus in 2022. Looking back further, Arrowood’s surplus has declined by almost 60% in the 21 months since December 31, 2020, when it was $90.4 million. That $37.8 million is a razor-thin margin of error when compared to the $612.0 million of loss and loss adjustment expense on Arrowood’s books.

Risk Based Capital

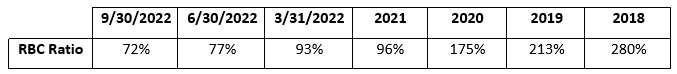

Another key metric used by regulators to evaluate the health of an insurance company is the ratio of statutory surplus to the authorized control level of risk-based capital (as reported on December 31, 2021), or the RBC ratio.

Over the past four-plus years, Arrowood’s RBC ratio has dramatically declined (see below). Note: Authorized Control Level Risk Based Capital is not reported on a quarterly basis and is therefore assumed constant for all of 2022.

At ratios between 70% and 100%, regulatory intervention can be taken as needed. An RBC ratio below 70% triggers mandatory control from the insurance regulator, the Delaware Department of Insurance. KCIC previously calculated that just an approximately $13.5 million decline in surplus would trigger mandatory control; Arrowood’s surplus has already declined by $12.5 million this year.

Arrowood’s financial statements note that it has submitted, and the Delaware Department of Insurance has accepted, an “RBC Plan” with the goal of improving its RBC ratio position. The details of the plan are not publicly available, and we remain skeptical of what possible steps it could include to salvage the sinking ship. We are still of the belief, based on the information available publicly, that Arrowood is under-reserved for emerging torts, including sex abuse, opioids, and PFAS. Meanwhile, Arrowood continues to face significant asbestos and traditional environmental liabilities. And while investment income has slightly outpaced the cost its run-off administration expenses in 2022 ($11.6 million to $10.7 million), it is not enough to make a material impact on the bottom line.

It now seems more likely than not that Arrowood will breach the 70% mandatory control threshold when its year-end financials are released in February. Should that occur, it will be interesting to see how the department reacts.

Takeaways

Arrowood’s predecessors were a significant part of the CGL insurance market until going into run-off in 2002. Policyholders facing legacy risks may have substantial exposure to Arrowood, often at the primary or umbrella insurance layers. They would do well to investigate what impact an Arrowood insolvency might have.

KCIC will continue to monitor Arrowood and other imperiled legacy liability insurers, and we stand ready to assist policyholders and their attorneys who are facing yet another large insurer insolvency.

Never miss a post. Get Risky Business tips and insights delivered right to your inbox.

Nick Sochurek has extensive experience in leading complex insurance policy reviews and analysis for a variety of corporate policyholders using relational database technology.

Learn More About Nicholas